Key changes for drivers in 2025

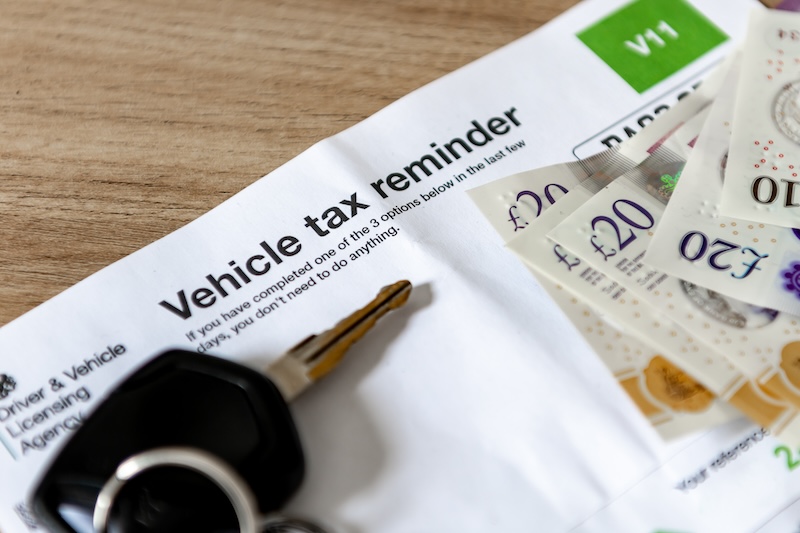

There will be a steep rise in VED in April 2025

2025 will bring about a lot of changes for drivers in the UK. Check out our list to find out which ones will affect you.

1. Electric vehicle owners to pay road tax

Electric vehicle (EV) owners are set to pay vehicle excise tax (VED) for the first time from 1 April 2025. VED, more commonly known as car tax, is determined by the age of your vehicle.

The rate for electric cars registered:

- On or after 1 April 2025 will be £10

- Between 1 April 2017 and 31 March 2025, £195

- Between 1 March 2001 and 31 March 2017, £20

Standard rates for other vehicle types are:

- £335 a year for vans

- £25 a year for motorbikes

In addition to this, EVs registered on or after 1 April 2025 will no longer be exempt from the Expensive Car Supplement, which applies to cars with a list price of over £40,000.

2. New sight test requirements may be introduced

The Driver and Vehicle Standards Agency (DVSA) has recently considered warnings from optometrists about the number of people who continue to drive despite their eyesight being below the legal standard.

The Association of Optometrists (AOP) is calling for the current law to be changed, requiring that all drivers have their vision checked when they first apply for a licence, when they get it renewed, and every three years after they turn 70.

Professor Julie-Anne Little, former chair of the AOP, stated: “Sight changes are gradual which means that many drivers are unaware that their vision has deteriorated over time. Having poor eyesight has been shown to slow reaction times and the ability to drive safely.”

While there’s no date set for when this change may come into effect, the DVSA is expected to publish their report on this matter in 2025.

3. New Fuel Finder scheme to be introduced

Formerly known as Pumpwatch, the Fuel Finder scheme will enhance fuel price transparency. All UK petrol stations will be required to report any changes to fuel prices or shortages within half an hour of them happening. This is to make sure drivers get the fairest possible deal on their fuel.

Expect to hear more on the scheme sometime in 2025.

4. Fuel duty freeze to continue

The Government has confirmed that the fuel duty freeze will continue as it is to March 2025 and until at least March 2026. This is to help alleviate the cost-of-living crisis.

Since January 2011, the fuel duty has been frozen to prevent it rising with inflation. The standard rate for petrol and diesel remains at 52.59 pence per litre.

5. End of Congestion Charge exemption for EVs

From 24 December 2025, the Congestion Charge exemption for EVs will cease. So far, drivers of EVs have been exempt from paying the £15 Congestion Charge in central London.

Driving within the Congestion Charge zone is free from 25 December to 1 January (inclusive) every year, so drivers of EVs will not actually have to pay the charge until 2 January 2026.

6. Safety camera trials end

Police forces have been working with National Highways to trial new technology that uses AI to catch drivers breaking the law. This includes those not wearing their seatbelt or those using a mobile phone while driving.

The tech was first introduced in 2021, and the latest trial will run until March 2025. The police are teaming up with the AI tech experts to help make roads safer. The system is designed to flag footage of drivers breaking the law and send it directly to the authorities.

7. VED rise

VED has been increasing with inflation since 2010. From April 2025, the first-year fee for petrol and diesel vehicles will see a substantial rise. The fees will increase on a sliding scale, based on CO2 emissions, with most higher tiers almost doubling in cost.

Models producing over 255g/km CO2 will face the highest increase of £2,745. This will affect some of the most popular brands on the market.

Check out our blog on the VED rise if you’d like more details.