Insurance coverage essentials for winter | 1st Central

Winter in the UK can be tough, with snow, ice, storms, and floods. Having the right insurance can help protect you and your home. Here are the main types of insurance you should think about for winter.

Home Insurance

Home insurance is important all year, but especially in winter. It usually includes:

- Buildings Insurance: This covers damage to your house, like the roof, walls, and floors. It’s useful for problems caused by storms, floods, or burst pipes.

- Contents Insurance: This covers your stuff inside the house, like furniture and electronics. It protects against theft, fire, and water damage.

Whilst you can get some very comprehensive insurance policies, it’s always worth checking out the additional extras to make sure you have the coverage you need. From Home emergency, to Accidental Damage, having that extra level of protection for your home can make all the difference.

Boiler and heating cover

If your heating breaks down in winter, it can be a big problem. Boiler and heating cover helps pay for repairs or a new boiler, so you stay warm.

Travel insurance

Winter weather can mess up travel plans. Travel insurance covers cancellations, delays, and medical emergencies. If you’re going skiing, make sure your policy includes winter sports cover.

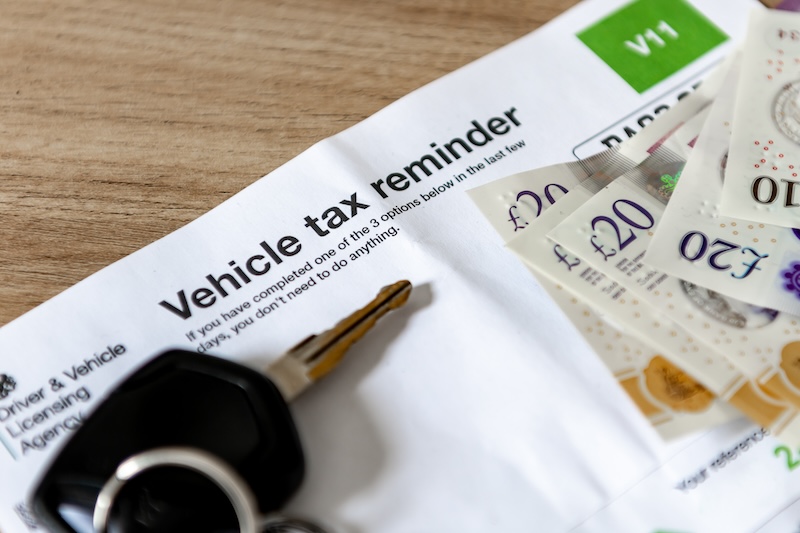

Car insurance

Driving in winter can be risky because of ice and snow. Make sure your car insurance is up to date. If you don’t already have it, adding breakdown cover to your policy is a good idea for extra peace of mind, especially when the winter months see breakdown numbers rise, especially at home where around 50% of breakdowns happen. You can add RAC breakdown cover to your 1st Central Car Insurance online via Your Account in just a few minutes.

Having the right insurance can help you stay safe and secure during the winter months. Make sure you’re covered and enjoy a worry-free winter, make sure you have the right coverage you need by heading online and visiting Your Account!